Efficient Market Hypothesis

Fundamental analysts analyse the intrinsic value of a company by studying various parameters like price to book, return on assets, its performance growth over few year, its liabilities, expected cash flows etc. Technical analysts on the other hand, reads stock patterns and predict future stock prices. They don’t need to know anything more , except the chart. They don’t even need to know the name of the company whose chart they are analysing. Sometimes both analysis may work in opposite direction. When prices rise rapidly , it may signal a technical uptrend and hence a buy. But fundamental analysis will show stock prices getting costly. Similarly on a heavy selloff , technical analysis will indicate a sell while fundamental analysis will recommend the opposite.

One Economic professor ,who was a proponent of Efficient Market Hypothesis ,asked his students to draw patterns by tossing coins. The students threw coins a number of times and drew the charts (1/2% up if head turns up and ½% down if it’s a tail).He took one of the charts and gave it to a technical analysts and asked him to predict the price trend of the company. The technical analyst predicted it had formed a bullish pattern and prices would go up (which in fact was a drawing of random outcome).

EMH, invalidates the fundamental analysis and technical analysis. EMH says markets are efficient in pricing. It says all stock prices are correctly priced according to current information and future returns are random. If true, it will make portfolio managers job redundant. The number of funds in US, beating the index (Market returns) on a long term(20-30 years) is quite less. It’s shown as one of the supporting points of the EMH and EMH suggests to invest in Index fund with low managing costs.

EMH doesn’t recognize the existence of bubbles. As markets are efficient, if prices are expected to go down in near future, market has to price in that immediately. Fama says he will accept bubble if a statistical method correctly says when the bubble will burst.

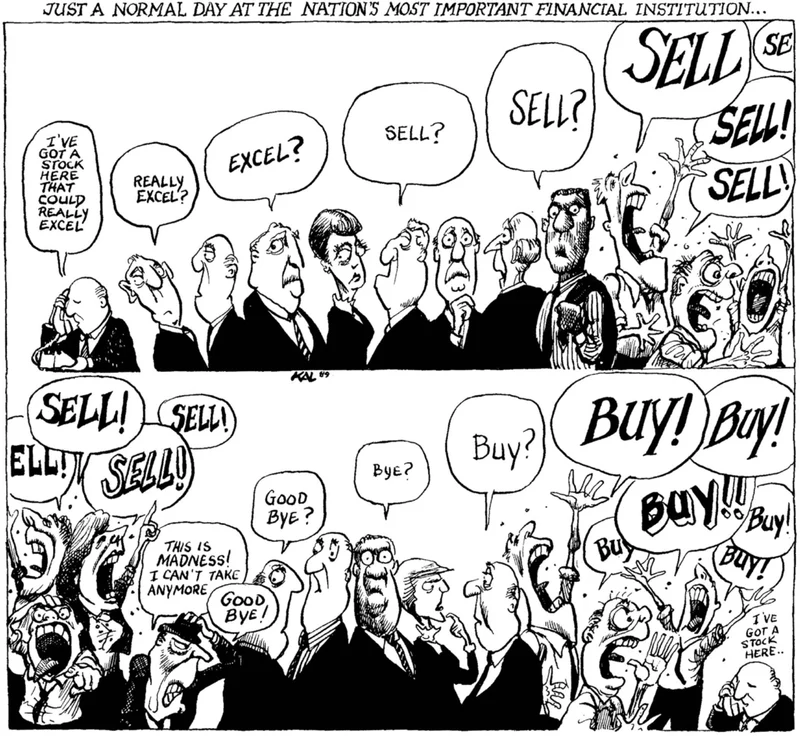

EMH has its critics too. There are investors who have consistently beat the market, say 25 years or more. (If its completely a luck, probability of this is quite low).Some have predicted the bubbles in the past. Sudden crashes in market can not be explained easily by EMH. Here is a famous cartoon that describes herd behaviour in stock market which is against EMH. It was published in 97 on ‘The Economist’ cover about rumours driven prices in stock markets

Comments

Post a Comment